Author’s Note: Thank you for your patience. I’m back for good. If you like this type of content, don’t forget to like, comment, and subscribe!

Prelude

What is an Assay?

Assay: to analyze (something, such as an ore) for one or more specific components.

Welcome to my first Assay (a homophone of essay) on the Creator Economy. An Assay is my version of the traditional VC investment thesis. The major way that its different is that I’m grounding my perspective of technology from a historical perspective, not current hot trends. If you can see how technology develops through time and how each one builds one another, it can help you anticipate today’s most promising activities!

I've spent plenty of time wading in the content creator space while writing for Forbes. Initially, it was a side project to my main beat of covering early-stage tech founders.

But then it became a thing of its own, eventually culminating in this article: The Rehabilitation Of Cameron Dallas.

I've always wanted to write about the intersection of content creation and technology. I'm glad I got to do it in the Cameron Dallas article and my coverage of Fanfix's acquisition, founded by Harry Gestetner, Simon Pompan, and Dallas.

Check out the video below for an in-depth discussion of the Creator Economy:

Introduction

This is an early version of my investment thesis on the Creator Economy. I want to show its evolution over time at its various stages of development and identify not only companies at each stage but also unsolved problems that future founders can aim to solve.

In 2020, venture capital firm SignalFire estimated that the Creator Economy has 50M creatives aiming to make a living through creating content online.

Goldman Sachs Research recently came out with a report mid-2023 stating the "creator economy could approach half-a-trillion dollars by 2027," up from "$250 billion today."

Even amid the recent economic tailwinds the U.S. economy has been experiencing, the Creator Economy's future still looks bright.

Kids no longer dream about being Neil Armstrong; they want to be the next Mr. Beast.

The typical creative goes through the following lifecycle: creating content, being discovered by distributing content on social media platforms, monetizing their content and overall following, building enduring communities of their most loyal fans, and then converting their digital clout into physical capital by selling tangible goods to a broader audience.

In this Assay, I dive into each stage of the creator lifecycle by identifying trends, established incumbents, notable startups, and, most importantly, potential new problems for future founders to solve.

There are areas that I will not be diving into: Web3, influencer marketing businesses, and creator financing startups. There needs to be more material progress or existing startups to endure in these areas. Influencer marketing businesses are incredibly common and need more differentiation to be ongoing standalone companies. Concerning creator financing, a significant market is absent at this stage of the creator economy that necessitates their existence. I am not bullish on these kinds of startups. I will, however, list the ones that exist for creator financial management.

Promising Opportunities List:

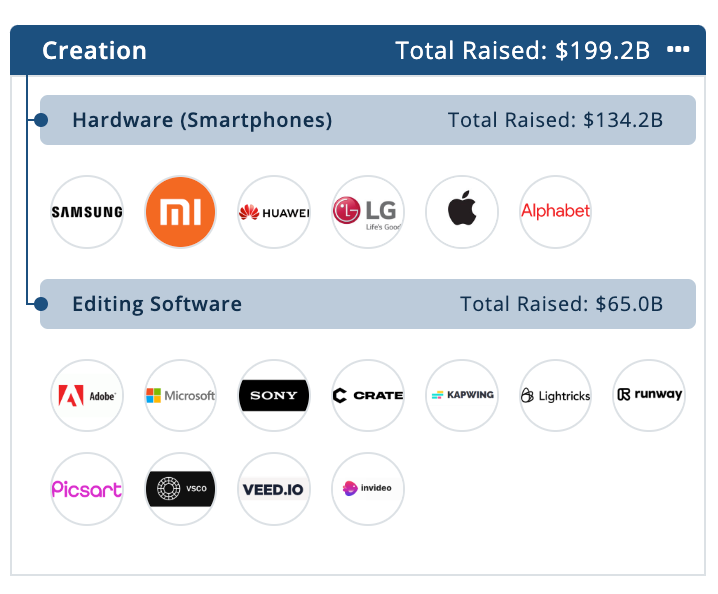

Creation

Hardware for IRL Live Streamers

Discovery

Helping creators connect with fans outside of centralized social platforms

Pseudonymous social platforms

Community

Analytics platform to identify your most passionate fans and curate them into an invite-only community

Conglomerate

Building a labor marketplace to vet/verify individuals who are interested in working in the creator economy

Connecting creators with manufacturers to help them rapidly produce their physical goods to then sell to customers.

Creation

What made mass content creation possible? There are multiple trends at play:

Hardware:

Software:

Centralized websites for content hosting & distribution

Robust, accessible desktop editing software such as, Windows Movie Maker, Sony Vegas, Final Cut Pro, Adobe Photoshop, etc.

The combination of these four trends led to content creation being viable for the masses in the early days of the social media era.

The most interesting opportunity for creators is the advent of a new hardware platform to leverage in creating content. Snap tried Spectacles and Google with Google Glass. Meta had pursued mixed reality (augmented + virtual; AR/VR) with its acquisition of Oculus in 2014 and then later on developed its own VR headsets with the Quest VR headset product line. Their latest headset, the Meta Quest 3, has finally begun generating positive buzz. However, Apple looks to make a huge splash in February 2024 with the launch of its offering, Apple Vision Pro.

Promising Opportunity: Developing wearable streaming tech for IRL livestreamers. Imagine wearing the equivalent of a pair of Snap Spectacles, but they had the additional capability to live-stream directly from the lenses. That means whatever you're staring at in public, your audience is staring at too. You can have their chat overlay on what you're seeing in real time (would require AR functionality) so you, the IRL streamer, can view and react to your audience.

IRL streaming is an extremely niche variant of the overall streaming space. Still, the behaviors we see with streamers in this niche could easily transfer over the broader public. Take the selfie stick + smartphone and turn it into a lightweight wearable that has high-quality data streaming capability.

Concerning software, there isn't much opportunity for a new startup to generate a lot of revenue. There are the major incumbents for professionals: Adobe (Adobe Creative Suite), Sony (Sony Vegas Pro series), Apple (Final Cut Pro), Snap (filter feature), and TikTok (CapCut, licensed music integration, other in-app editing tools) and mobile-based startup video editors such as Kapwing, Picsart, Lightricks, FaceTune, and others.

However, one recent emerging success is PhotoRoom, an AI-powered mobile photo editing app. PhotoRoom reached $50M+ ARR in just three years.

Discovery

Before Facebook, there was Myspace, the original social networking platform. Launched in 2003, it was the first successful American social media company. At the height of its power, it grossed over $800M in revenue in 2007. It was acquired by News Corporation for $580M in 2005, showing that these early Internet companies could generate great returns for investors and management teams.

The late 2000s and early 2010s were the age of social media platforms. Facebook (now Meta), Snapchat (now Snap), Twitter (now X), and YouTube were the early standouts. For the first time, creators would have centralized websites to upload and share their content with other users.

Instagram dominated photos. YouTube dominated (and continues to dominate) video. Audio-based startups wouldn't come until later (e.g., Clubhouse, Twitter Spaces feature). Live Streaming wasn't a thing yet. However, Periscope (acquired by Twitter) led the way, followed by Twitch (acquired by Amazon for $1B). Social media companies were prime candidates for venture capital (VC) funding because of their network effects (the network becomes more valuable as more people join, thus enticing more people to join) and the near-zero marginal cost of serving an additional user.

Vine (acquired by Twitter) was a game changer for social media. The video-only app launched with the feature of videos being a maximum of six seconds in length. Vine's popularity was viral. The new social media app delivered a paradigm shift with the six-second video length limitation; it lowered the bar to entry for content creation. Most videos at the time were many times longer than six seconds, and content recommendation algorithms like YouTube factored in user watch time on videos to push them to the trending page.

Snapchat (now Snap) was also a paradigm shift for social media, as ephemeral content did not exist until Evan Spiegel created it with his first version of Snapchat. The default assumption is that your content would persist (forever) after being uploaded, so the idea that it would disappear after some short time was completely novel.

As I wrote in my Cameron Dallas piece, "Vine walked so TikTok could run. Now, every social media platform is obsessed with short-form videos, such as Instagram Reels and YouTube Shorts."

TikTok completely upended the social media industry. It was thought that Facebook, Instagram, Snapchat, YouTube, and Twitter had completely dominated the space. But the ByteDance-owned core innovations in its recommendation algorithm, in-app editing features, and various monetization options make it a differentiated app. TikTok was so successful that Instagram and YouTube shifted their video strategy to compete. (I believe Twitter could and should have made Vine into something like TikTok, but that's another story for another time!)

Content creators leveraged these platforms to first establish and then grow their followings.

One canonical problem with social media platforms is that creators are locked in; they can't transfer their followers from one platform to another. Creators do not own their own content distribution. While this is a consequence of the social media platform product design themselves, creators face platform risk where the algorithm driving content recommendation could shift to not be in their favor, or they could be found in violation of the platform's content moderation policies.

Another problem is that creators do not own their followings on each platform they exist on. Sure, they can increase their follower count, but if they get banned or their content falls out of favor with the platform's recommendation algorithm, it won't matter how many fans they have if their content never reaches them.

Promising Opportunities:

Building software to help creators reduce platform risk by helping them connect with their followers outside of them. Newsletters, such as Substack and Beehiiv, are one possible way, but most fans of creators connect with their idols through photos and videos, not text. Link-in-bio companies such as Beacons and Linktree do a great job of leveraging the bio sections of social media platforms to redirect fans to connect with their favorite creators on other social media platforms as well. There's a lot of opportunity for creators the opportunity to connect and build relationships outside of the content they post to a particular platform.

Building a pseudonymous social media application: the rise (or return) of anonymous, community-based social media apps like Fizz and Sidechat are reminiscent of Yik Yak in the mid-2010s. Moreover, ephemeral social media apps like Tbh, Gas, and NGL have become popular with Gen Z, especially over time. Gen Z, as much as they are addicted to TikTok, are not as interested in having an online presence tied to their real-life identity. The next big social media platform should take advantage of the anonymity trend among Gen Zs.

Monetization

Out of all the stages, monetization for content creators is the most challenging. Correspondingly, it's the most crowded space of startups tackling existing problems. For influencers whose content successfully attracts fans, the former now has the opportunity to monetize the latter. There are many ways of doing so. The most common is ad revenue from large platforms such as YouTube and Facebook. Other platforms, such as Instagram and TikTok, allow for branded content or sponsored ads (as long as they are disclosed properly according to FTC regulations). Streaming platforms like Twitch allow viewers to subscribe to their favorite Twitch streamer for $5/month, which is split between the streamer and the platform (the exact split depends on whether the former is an Affiliate or Partner).

There's a major tension between the Discovery and Monetization phases of the content creation journey. The bulk of a content creator's revenues, if successful on a particular platform, are tied to how the platform makes revenue. This is detrimental in two ways: one, if the platform has poor financial performance (e.g., YouTube adpocalypse), then creator revenue is directly impacted. Moreover, suppose a content creator violates a social media platform's content moderation policies. In that case, they risk being banned and thus losing access to their earnings.

Those risks naturally condition creators to be more conservative in their content, which could impact their relationship with their fans, and thus, their revenue could also continue to decline. Furthermore, moderation policies of these platforms, such as YouTube and especially Twitch, are usually applied on a case-by-case basis. The instability of these policies and the ongoing business risk inherent to these platforms makes creator monetization uncertain. It is so uncertain that you now have startups such as Patreon, FanFix, Subify, or Passes that allow creators to have their fans subscribe to them directly to access content only available on the platform.

Discovery and Monetization phases of content creation are slowly, but surely, being decoupled as a response to the instability and risks creators face by bundling both through social media. More creators leverage platforms like TikTok to be discovered, and then figure out ways to get them to a website like FanFix where they can be monetized via subscription.

According to Goldman Sachs, the overwhelming majority of content creators still rely on brand deals, which are not the most reliable revenue stream. Various startups are working to help creators monetize in other fashions, like Pillar, which helps creators sell courses and digital content to their fans, or Buy Me A Coffee, which allows fans to tip their favorite digital stars.

Diversifying their revenue streams is key for most creators to survive long-term. Most are still overly reliant on revenues from brand deals and ad share, as those are the most common ways to make money online. Other monetization methods have a higher barrier to entry and require more effort to generate recurring revenue and eventual profit.

The creator monetization space is already crowded; there isn't much room for venture-scale untapped markets that haven't been addressed. I expect some of these startups to be acquired at some point, as Passes did with their acquisition of Fanhouse.

Community

Community is a historically underrated part of the content creator experience and journey. Most creators go from having small followings to blowing up overnight due to one viral video. There's no in-between for most creators. However, regardless of size, there's immense value in the ability to curate communities that can become the engine of a creator's growth and engagement on all platforms.

Back in the day, I remember using an Internet Relay Chat (IRC) for text and TeamSpeak for audio to keep in touch with my closest online friends when playing RuneScape, my favorite browser-based Massively Multiplayer Online Role Playing Game (MMORPG). However, when we talk about online communities today, the first thing that comes to mind is Discord. If you're a gamer, you most likely use Discord as your space to host your party chat while playing a multiplayer game or just chilling out in between sessions. The $15B private company is synonymous with online gaming communities. Gaming content creators always use Discord to keep in touch with their most loyal, engaged followers and fans.

Outside of gaming, there's software tailored to help build specific niche music-affiliated communities like Rivet or more general social media-driven communities like Circle. For professionals, startups like SoWork, Gather, or Mighty Network can help those in the corporate world find like-minded people to join groups to boost their careers.

Promising Opportunity:

Analytics platform to identify and curate your most passionate fans into an invite-only community. The power of community can be the difference between someone becoming a full-time content creator versus just being a side hobby. If there were software that could scrape or ingest data from major software platforms that identify your most passionate fans, then inviting them to a selective community where they can directly connect with you would be powerful. Such a community can serve as a testbed for new content ideas before a creator shares it with the wider world, or they can be the early adopters for new merch and help drum up marketing buzz around the product launch.

Conglomerates

Few internet influencers make it to this stage. But if they do, it's a combination of hard work, savvy risk-taking, and good luck. Most followers at this stage are north of 20M+ followers across all social media platforms. They can command large fees for brand sponsorships, ad deals, and other third-party collaborations. They also most likely have successful product sales in the form of clothing lines or consumer packaged goods.

For example, one of the earliest content creators to turn their clout into capital was Jeffree Star, one of the first beauty influencers on YouTube. His eponymous company was estimated to do over $100M+ in revenue according to Forbes in 2019.

More recently, Logan Paul and KSI debuted Prime Hydration in 2022, and Bloomberg reported that Prime was on track to do $1.2B in revenue in 2023. The two social media influencers are borderline celebrities, and their joint venture, driven by their combined clout, paid off massively. Each apparently has a 20% stake in the company.

At this level of stardom and social media reach, creators usually have teams of 30+ or more working under them with various initiatives. At this point, they cease to be just content creators and become founders of companies in their own right.

From my Forbes story on Dallas:

"One having a stake in the intellectual property and equity in a growing consumer brand is the best way to build long-term, massive wealth, akin to Kanye West's Yeezys, Rihana's Savage x Fenty, and Kylie Jenner's Kylie's Cosmetics."

Many content creators struggle to reach this level of becoming a conglomerate or building a standalone business bigger than themselves because they cannot get the right people around them.

In addition, many creators, even larger ones, can still be taken advantage of by brands and businesses of all sizes. Most content creators must learn to navigate the legal and financial side of negotiating brand deals or sponsorships.

While social media is getting close to being roughly two decades old, many norms still need to be implemented to build trust between content creators, brands, marketing agencies, and other relevant third parties.

Some of the largest creators succeeded because someone introduced to trustworthy, reliable, and competent individuals who wanted to be a part of their team at the right place and time in their creator journey.

Promising Opportunity:

Building a labor marketplace to vet/verify individuals interested in working in the creator economy. Most founders and investors focus on building and supporting companies on the revenue side of a creator's business, securing brand deals, sponsorships, and other kinds of income from companies wanting to leverage influencer marketing. But no one focuses on the labor side of the equation: how can software help creators find individuals to employ and collaborate with? These types of folks could be editors (good ones are hard to find), personal assistants, managers/agents, etc. Such software is critical to helping a creator to have the right team to assist them in maximizing their revenue when those opportunities come.

Connecting creators with manufacturers to help them rapidly produce their physical goods to then sell to customers. Few vendors provide white-labeled goods for creators to throw their brand on and sell to their fans. For creators who rise and get to this stage of their careers, a platform matching product vendors to creators would benefit both sides. Some brands exist on social commerce websites such as SuperOrdinary (founded by Julian Reis) that work with creators (e.g., those present on FanFix, the startup they recently acquired) to promote these brands to Southeast Asian audiences.

Summary

The content creator lifecycle has continued to evolve over the past two decades. There are many important problems for founders in this space to solve. Speaking of which, more creators are becoming founders as they scale and monetize beyond the content they publish to these platforms. The line between creators and founders gets blurrier as time passes.

Thank you so much for reading my first Assay! I deeply appreciate the time you all took. I would love your feedback in the comments below, and I'm open to any feedback!

I can't wait to write the next one!

Frederick ‘Soda’ Daso