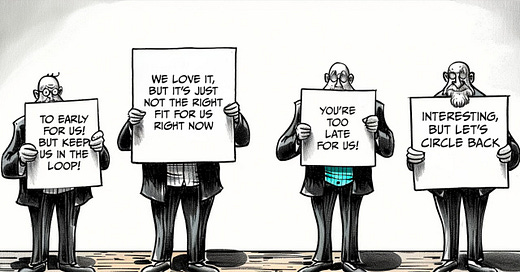

The Best Answer You Can Hear From A VC Is Not "Yes"

It’s better to hear a hard-earned no than a hype-driven yes.

Author’s Note: I'm sorry for the delay in this article. It’s been a long week of work related to General Catalyst Venture Fellows and my first full week of school back at HBS!

This is probably one of the most counterintuitive columns I’ve ever written.

If you’re at the early stages of your startup, when you’re fundraising and receiving decisions from investors…

…it’s better to hear a “No” than a “Yes.”

Yes, you read that right. To be more precise - it’s better to hear a hard-earned no than a hype-driven yes.

How do I know this?

I’ve been on different sides of the startup ecosystem: for Forbes as a journalist and venture investor prior to attending HBS. I see it all the time as a venture fellow for General Catalyst.

Even in the positive case where one successfully raises, I have countless stories of founders confiding in me if they were to raise another round, they would not raise from some of the same investors currently on their cap table.

Hype closes rounds quickly, but venture is a long-term game.

The best investors will not give in to the hype and say no, but with rich feedback for the founders to digest and implement going forward if you make it far enough in their process.

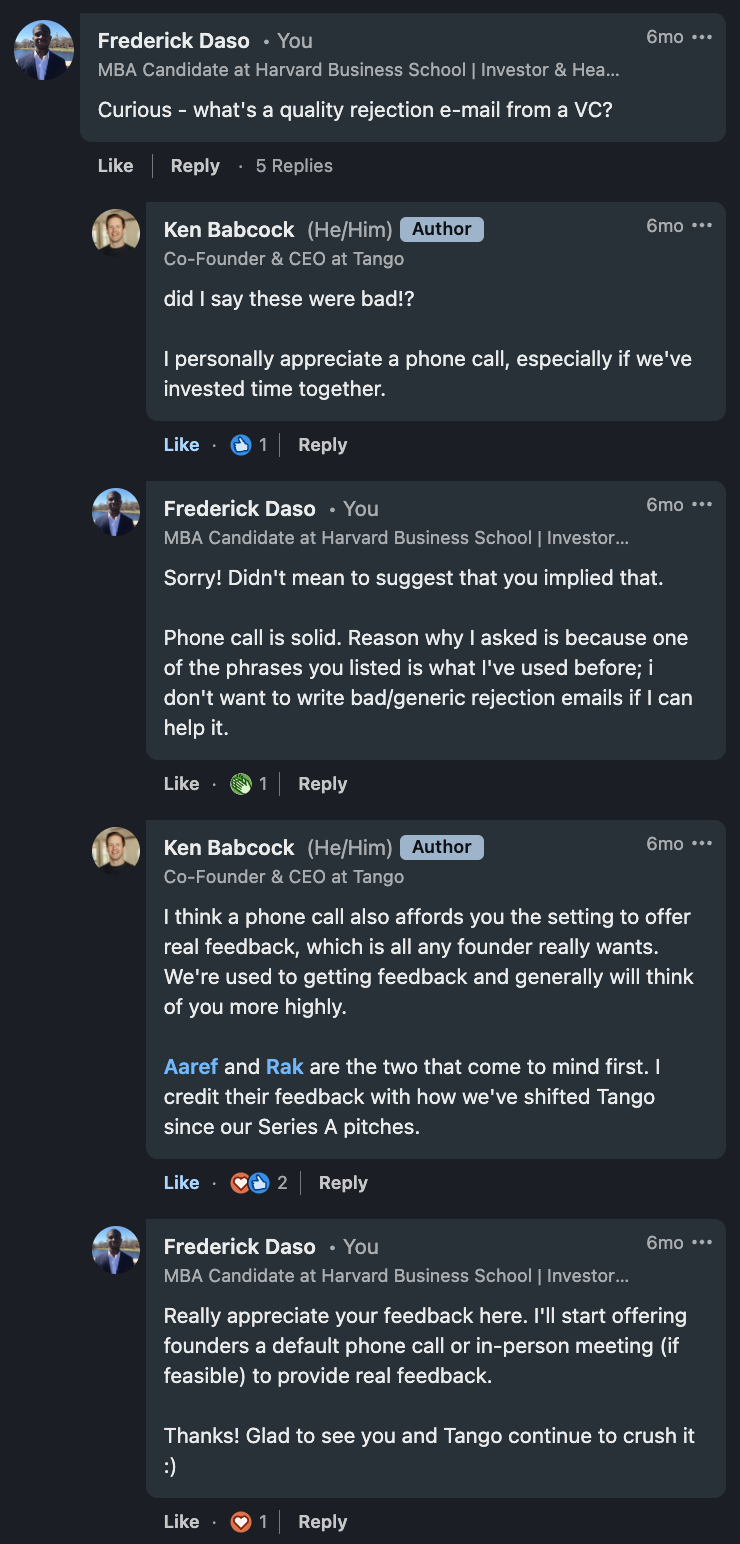

A VC who is willing to sit down with you face to face or over a call and communicate in granular detail why their firm passed on your startup, is a VC that you want on your cap table. Their company is doing extremely well, by the way! I covered them on Forbes a while back :)

Below is my exchange with Ken Babcock, co-founder and CEO of Tango (and HBS dropout!) on his original LinkedIn post!

Very few VCs provide direct, frank feedback because they *reasonably* worry that it can come back to bite them in the butt, and it’s easier to not give feedback at all when the majority of their time is spent searching for the next big startup.

(I’ll be honest, I’ve been burned by founders not keeping the feedback I provide them private. It’s a gross violation of trust, especially when it’s far easier (and most likely more prudent) to not provide feedback.)

That being said, providing honest, genuine, and actionable feedback is the foundation of a true founder-investor partnership.

A hard-earned “No” can change the trajectory of your company for the better, if you’re wise enough to listen.

Soda