Case Study: Finary's Product-Market Fit Journey Starts With 'Building For Yourself' To Build Something Useful For Others

By building for yourself, you can figure out what to build for others to find PMF.

Contact Roger Cawdette at: roger@finary.io

Introduction:

Roger Cawdette is the co-founder at Finary (YC W21), a chat platform for investing. Born and raised in Boston, he attended college at Harvard, where he studied Technological & Social Innovation. During his sophomore year, he started Finary with a classmate and dropped out the following summer to go work on the company full time. Before his startup, he worked in venture capital at Blackship Ventures and is still a Venture Partner at Contrary. Roger is 21.

Problem: Investing as a young person is incredibly scary. We have very few people to talk about investments with and it can be very difficult to find quality investing discussion online.

Market: In the US alone, there are about 43 million millennials who invest in the stock market. On top of that, there are tens of millions who visit investing discussion sites, with the most popular having 15 million users.

Solution: Similar to Discord, Finary allows anyone to follow the investing opinions of others. What is different from us, however, is that our users are able to share their thoughts with features specific to investing, they’re able to display their actual portfolio and its performance, and they’re also able to make trades directly from the site.

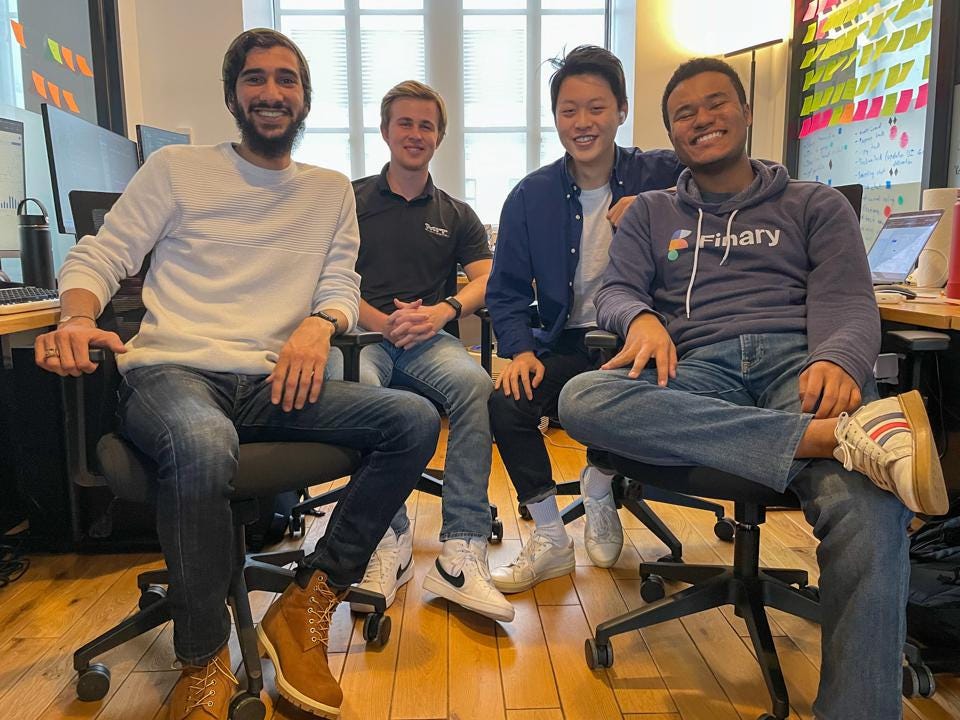

Team: Our co-founding team is a collection of students from Harvard and MIT including myself, Mike Liu, Jack Phifer, and Darian Bhathena. We found one another through our shared interests in startups as well as our frustration with the investing experience for people our age.

Executive Summary:

Problem: Simplifying Your Solution To Addressing One Core Issue

Cawdette and his co-founders struggled with trying to solve many problems early users faced when trying to acquire solid investing information. They realized that they needed to narrow their focus on one core issue before building a solution.Market: Observing User Behavior Reveals Customers With A Specific, Unmet Need

Cawdette and his co-founders realized that there was a potential, growing market of casual investors as they kept observing the following: “Almost all of them were resorting to iMessage and Whatsapp to create informal investing clubs with their friends.”Solution: Build A Product Or Service That Improves Existing Behavior

Originally, Finary set out to build a classic social network for casual investors. However, they pivoted after realizing it was easier to build a dedicated, refined group chat platform as people were already making informal WhatsApp and GroupMe investing-focused group chats on their own.Team: Prioritize Rationality As The Basis Of Decision-Making

The Finary cofounders don’t shy away from debate; they encourage it. They have consciously built a culture that is supported and directed by being rational, or looking at what is objectively best for Finary as a whole.Takeaway: Building Something You Would Use Is A Great Way To Build Something Everyone Wants

It’s hard to figure out initially what problem you should be solving first for users. A great way to discover that is to build something that you would use, for that insight gleaned may be applicable to others who need what you’re building as well.

Case Study: Finary

Problem: Simplifying Your Solution To Addressing One Core Issue

Tell me about a problem or set of problems that you've had to solve on your journey to product-market fit.

We're still on the journey to finding product-market fit, but we've discovered that the most important component of this process is identifying the problem to start with. For the first six months of Finary, I think we did an excellent job of digging into the user research to understand the social investing space better, but we made the mistake of trying to solve too many problems at once. In the first iteration of our product, we set out to build an open forum platform similar to what could be described as Reddit for investing.

We wanted to solve the lack of transparency and accessibility to investing tools and the overflow of low-quality posts commonly found in online investing forums. And for a while, we had the gut feeling that we were spreading ourselves too thin but never really took the time to admit it to ourselves. In our first office hours at YC, we realized that we seriously had to simplify things.

The lesson here is that you can solve as many problems as you want in your company's grand scheme, but ultimately you have to identify a specific one to start with.

Why were these problems so critical to solve? What was it like personally struggling to overcome these challenges to achieving PMF?

Once we figured out that we needed to settle on one problem and build a really awesome solution for it, our product roadmap became increasingly clear. In the early days of Finary, I now realize in retrospect that we often struggled to describe to our friends and even ourselves what we were working on. On some days, we thought we were building product A only to realize that we were making products B, C, and so on. Even though it's funny to look back on those days and laugh, it's also important to note that we did end up wasting a lot of time that could've been much better spent. Startups can be fun but a lot of the time, but they can also be incredibly taxing, and not understanding what you're working on only makes that worse.

The lesson here is that to understand what you're building, you first need to understand what problem you're solving.

The lesson here is that you can solve as many problems as you want in your company's grand scheme, but ultimately you have to identify a specific one to start with.

Market: Observing User Behavior Reveals Customers With A Specific, Unmet Need

Let's get deeper into the pain point or points you were trying to solve. Imagine I'm a customer thinking about using your product or service. How do you go about understanding my pain and creating a solution to address it?

One of the most significant pieces of advice they give at YC is to talk to users. Although we did several not-so-great things early on, we did that one thing pretty well. Over the first couple of months of Finary, we spent quite a bit of time investing in subreddits and Yahoo Finance message boards interacting with strangers just trying to get a better sense of their experiences. Sometimes we'd post about Finary, go through and respond to each thread (even the ones that weren't very nice), and try and convince them to hop on a call with us. Most would say no, but some would say yes, and those short chats provided us with a wealth of knowledge that allowed us to better empathize with our users. Despite eventually pivoting, it's the insights from that initial user research that helps inform some of our product decisions today.

The lesson here is to talk to users.

Assuming you've managed to address the pain points I face as a customer, what additional information did you discover in your journey to PMF that there's a large market in need of a solution to the existing problem?

Our team's first hint was the observation that more and more of our friends at school were starting to invest in the stock market. Almost all of them were resorting to iMessage and Whatsapp to create informal investing clubs with their friends. Out of curiosity, we sent a survey to our networks on social media. We quickly discovered that most people who were investing got involved through their friends, family, or social media forums. And most of the people who weren't supporting did so because they didn't have friends to invest with.

The clear answer here was to set out to build the next big social network for investing, which remains today as our ultimate vision. Additionally, in doing the months of user research on Reddit and other social media platforms, we further realized the scale of the opportunity and how many people were in deep need of a place to talk about their investments. The current episode around r/wallstreetbets has arguably made this even more so of the case, so we're super excited to be building something that fits the times.

The lesson here is to confirm your theories with research.

How did you narrow your scope of what portion of the market you wanted to tackle first? Who did you decide would be your first beachhead customers and why?

This one is straightforward. Another great piece of advice we received at YC was to build something we would use and that our friends would use. As a Gen-Z team, this effectively meant making for the younger side of the market.

The lesson here is to build something you would use.

Additionally, in doing the months of user research on Reddit and other social media platforms, we further realized the scale of the opportunity and how many people were in deep need of a place to talk about their investments.

Solution: Build A Product Or Service That Improves Existing Behavior

How did you build your solution to maximize its relevance with the customer and ensure product-market fit? If you haven't found PMF yet, what have you learned? What are the blockers for getting to PMF?

Continuing off the last answer, this process hasn't been as difficult for us because we've decided to take something people already do and create a better experience. For more context, after the office hours session I mentioned above, we all came back to the realization that our team and many of our friends were already using messaging apps to create informal investing clubs. And on top of that, they'd take screenshots from Robinhood and articles from the Motley Fool and dump them into their chats in a very disorganized fashion. There was room for improvement. Rather than reinventing the wheel and pushing users to do something new for investing, we decided to build a messaging platform with attached investing tools, data, and news, simplifying what they were already doing.

The lesson here is that improving an existing behavior is easier than creating a new one.

What are some of the things you did that "didn't scale" to shape your solution today?

The user research we conducted in the early days is probably the most unscalable thing we've done. Responding to every point of feedback, taking the time to understand their perspectives, and establishing a long-term connection was feasible for one hundred people on Reddit. Still, with more responsibilities for our team today, we, unfortunately, don't have the same bandwidth. Even so, we always maintain unscalable practices like making personalized groups for anyone interested in joining and walking them through all the available features. Soon enough, this will not be possible, but in the meantime, we appreciate the privilege of being able to interact with our users one on one.

The lesson here is to cherish the unscalable practices. They won't be possible forever!

What did you learn to best engage with your customers? How did you build a tight feedback loop with your customers to rapidly improve your solution to their problems?

Analyzing metrics is excellent, but having quick casual exchanges with users is the real driver of our product refinement process. What that currently takes form is a feedback group on Finary where all of our users are free to share their thoughts on the platform, voice complaints, and request features, all with the guarantee of someone on our team responding. In our experience, strong feedback loops aren't just based on volume and speed, it's also based on building a feeling of trust between you and your users, so they feel empowered to share their real thoughts.

The lesson here is to invest in and build relationships with your early users.

Walk me through how you landed your first few customers as you were building your product or service.

Like I mentioned before, we were building a product for our team and our friends, and as it turned out, that was the case. We were the first users of the product, and one of our most active groups today is the investing group chat of one of our co-founder's fraternity. Because Finary is a clear improvement on existing options, the opportunity for organic growth has been apparent. We see in the numbers that our users create additional new group chats for their friends and family. Those new users are forming groups for their friends and family, and so on.

The lesson here is that if you and your friends love a product, there are probably more people out there who will love it too.

The lesson here is that improving an existing behavior is easier than creating a new one.

Team: Prioritize Rationality As The Basis Of Decision-Making

If you have co-founders, walk me through a time that you two had a conflict. What was it about? How did you handle the situation? What was the resolution, and how did it impact your working relationship with your co-founder?

On a co-founding team of four, we have disagreements all the time, and that's okay. Sometimes it's big things like whether or not to raise money from a specific investor or small things like a button's size. Regardless of the importance, our team engages in full fledge debates quite often, and I'd consider it one of our strengths. It's this high level of passion for the product and our collective willingness to advocate for what we each believe in that drives our team. Coming into the office every day with the feeling that everyone cares about the company's future and is willing to go to bat for it is incredibly empowering. In the end, it's the rationale of the given argument that wins out, and this has served us well.

The lesson here is to build a culture where rationale wins out.

If there was a potential employee of your startup reading this Case Study right now, how would you convince them that joining your team is the next best step in their career?

If we've learned anything from this ongoing episode around r/wallstreetbets and the stock market, it's that investing is fundamentally becoming more social. People no longer want to make trades alone. They want to do so in consultation alongside others, even strangers on the Internet. There's a need for something better here, a real investing social network, and that's what we're building at Finary. Our mission is to create a digital community for the next generation of investors.

Regardless of the importance, our team engages in full fledge debates quite often, and I'd consider it one of our strengths. It's this high level of passion for the product and our collective willingness to advocate for what we each believe in that drives our team.

Takeaway: Building Something You Would Use Is A Great Way To Build Something Everyone Wants

What are the key lessons you have learned so far from your journey to achieve product-market fit?

I've always appreciated the use of quick snack-sized advice, so here it is:

Great products solve a problem, spark joy, or do both.

Start with one problem

Understand what problem you're solving

Go to your users

Talk to users

Back up your theories with research

If possible, build something you would use

Improving an existing behavior is easier than creating a new one

Be grateful for the unscalable practices; they won't be possible forever

Build relationships with your early users

If you love your product, others probably will too

Build a culture where rationale wins out

Optimize for learning: Roger Cawdette, Learning as a Founder

What's the most challenging problem you're facing now after solving the prior one(s)?

These days, we spend most of our time building new features, talking to users, and fundraising. Understandably, the hardest thing for us is figuring out how to optimize productivity while fielding all of these responsibilities. Honestly, I can't say we've come up with a defined approach, but we're learning on the fly and adjusting as we go.

The lesson here is to learn as you go and make rapid adjustments accordingly.

Three Cool Founders You Should Know About:

Stella Han & Carlos Trevino, Co-Founders at Fractional: Fractional is a full-service platform to own fractions of investment properties.

Sam Yang, Co-Founder at Thryft: Thryft is a curated, controlled marketplace for secondhand clothing & accessories.

Landon Smith, Founder at Strada Routing: Strada Routing is an automated load bundling and bidding for truck shipments.

Previous F2F Case Studies:

Case Study: This Founder Doesn't Believe In Product-Market Fit. Yet His Startup Is Growing Rapidly.

Case Study: Learn How Fluent Understood User Emotions To Guide Their Product-Market Fit Journey

Case Study: Eze Relied On Fast Product Iteration To Reach Their Product-Market Fit Goals

Case Study: Blerp CEO Aaron Hsu's Search For Product-Market Fit

Case Study: Arize AI's Cofounders Discuss Their Path Towards Product-Market Fit

Case Study: Vizy CEO Amos Gewirtz Figured Out How To Increase User Engagement Of Their Product

Case Study: Doppler (backed by Sequoia) CEO Brian Vallelunga Found Growth By Killing A Product

Case Study: Segment CEO Peter Reinhardt On How His Startup Achieved Product-Market Fit

Case Study: Segment President Ilya Volodarsky On How To Effectively Use Data Analytics In A Startup

Case Study: Behind The Fundraising And Founder Success with Instabug's Omar Gabr

Case Study: Paragon CTO Ishmael Samuel Reflects On How He Chose His Cofounder

Previous Startup Spotlights:

If you enjoyed this article, feel free to check out my other work on LinkedIn. Follow me on Twitter @fredsoda, on Medium @fredsoda, and on Instagram @fred_soda.